Few of them, but there are still accounts that buck the widespread trend of charging commissions to untethered customers. They are basically offered by neobanks, online banks and some other traditional entity with a single requirement: that the operation be 100% digital. They use the lower cost structure of digital banking – they do not have bank branches – to stay against the movements of the sector in recent months, which has chosen to raise commissions to face the poor returns compared to interest rates. negative interest from the European Central Bank (ECB).

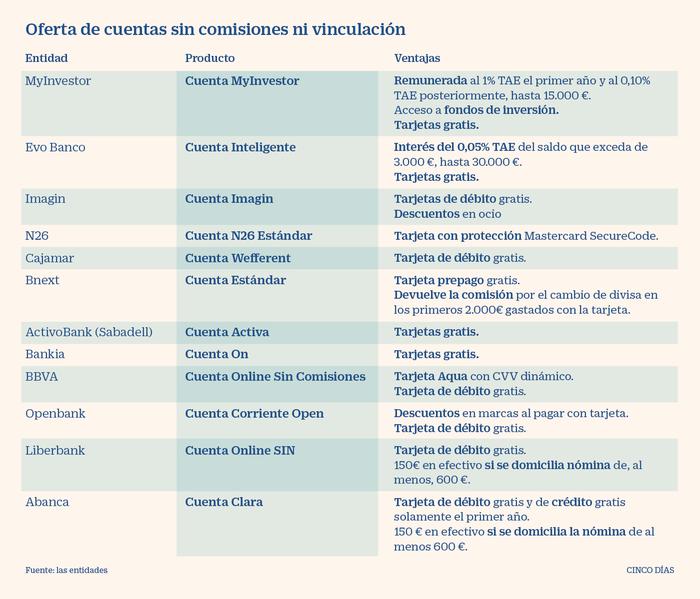

Thus, while Santander and CaixaBank customers can pay up to 240 euros a year for account maintenance if they do not meet certain requirements, such as direct debiting payroll and receipts or making purchases with cards, users of its digital subsidiaries, Openbank and Imagin, enjoy free without even the need for income. The Open Current Account also offers discounts when making purchases with cards from brands such as Booking.com, Just Eat or Club Vips. For its part, the Imagin Account of the mobile bank, focused above all on a young audience, also offers discounts on leisure.

"The financial sector is going through a difficult time, which has led banks to look for ways to get out of the current economic situation, such as modifying several of their most basic products, completely transforming the account landscape," explains María Pérez , director of operations at Afinia Digital, who points out that “finding an account without commissions has become an increasingly difficult task to achieve, but there are interesting options”.

Among the neobanks, allies of technology, the MyInvestor account has the added advantage of remuneration. Up to a maximum of 15,000 euros rent 1% APR during the first year and 0.10% after. On their side, N26 and Bnext allow you to withdraw money without commissions at foreign ATMs, although free cash withdrawals are limited. “Neobanks are the new fashionable product among financial institutions in Spain. The advantages are clear. The fact of charging few commissions, in many cases none, and having modern systems that are easy to use and fast, are convincing a society where the millennial generation increasingly has more purchasing power”, indicates Josep García, co-founder of the comparator Mejor-banco .com, who adds that "traditional banking is making great efforts to offer similar products."

MyInvestor and Evo Banco offer the added advantage of remunerating the money in the account

Evo Banco eliminated all commissions and linking conditions at the end of 2020. In addition, it offers a certain return on savings, 0.05% APR up to a maximum of 30,000 euros. BBVA and Bankia also have online accounts without commissions, in which it is not necessary to have a payroll. The entity chaired by Carlos Torres has recently improved the security of its card with a special anti-fraud protection that includes a dynamic CVV. For the other accounts, BBVA charges up to 100 euros to unrelated individuals, and Bankia 168 euros a year if the income is not directly deposited. Banco Sabadell charges 60 euros per year, but has a free alternative in ActivoBank.

To protect the consumer, the Ministry of Consumer Affairs and the communities will consider it unjustified for a bank to start charging if the account contract includes phrases such as "no fees" or "zero commissions", according to the Government website. A criterion that could shake the recent increases in bank commissions.

Incentives for direct deposit of payroll

Cash. Some commission-free accounts encourage the direct debit of the payroll. For example, Deutsche Bank has extended the bonus of up to 480 euros in its More DB Payroll Account for new digital customers who have assets of at least 1,500 euros per month and who contract the product through the app. In addition, it is necessary to make at least four debit purchases or one credit purchase per month with the associated cards. The offer is valid until February 28. For its part, Liberbank does not require payroll in your Online Account Without, but if you take it, you pay 150 euros in cash. The minimum amount is 600 euros. The promotion is valid until June 30, 2021. Likewise, Abanca gives 150 euros for direct debiting the payroll in the Clara Account until February 28. In all cases, the minimum stay to enjoy the gift is 24 months.

Youths. BBVA has the Va Contigo Payroll Account for Young People without commissions or conditions, which gives 100 euros gross to those who are already working and have a payroll of more than 800 euros per month.